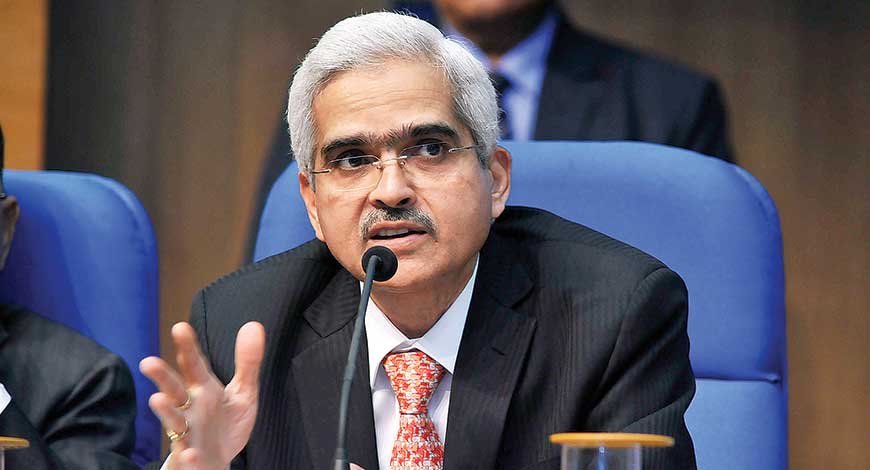

RBI Governor: GDP Growth In 2020-21 To Be Negative

Gross domestic product development in 2020-21 to be in the negative domain: RBI Governor

RBI cuts benchmark loaning rate by 40 bps. In an unexpected move, the Reserve Bank of India on Friday cut the benchmark loaning rate by 40 basis points to moderate the effect of the COVID-19 emergency.

In an off-cycle meeting of the Monetary Policy Committee (MPC), the choice was taken collectively to slice repo to help development.

Following the decrease, the repo rate has boiled down to 4 percent and the opposite repo rate has been sliced to 3.35 percent.

The MPC, headed by RBI Governor Shaktikanta Das, has last diminished the repo rate (the rate at which national bank loans to banks) on Walk 27 by an amazing 0.75 percent to 4.14 percent.

Das said the swelling standpoint is exceptionally questionable because of the episode of the COVID-19 pandemic and communicated worry over raised costs of heartbeats.

He likewise said there is a need to audit import obligations to direct costs.

Feature swelling may stay firm in the main portion of the year and may ease in the subsequent half. Expansion may fall underneath 4 percent in the third or final quarter of the current financial, as indicated by the Senator.

Further, Das said government incomes have been affected seriously because of the lull in monetary action in the midst of the pandemic.

Das broadened the ban on the installment of advances by an additional three months till August to give truly necessary alleviation to borrowers whose salary has been hit due to the coronavirus emergency.

In Spring, the national bank had permitted a three-month ban on the installment of all term advances due between Walk 1, 2020, and May 31, 2020.

Appropriately, the reimbursement timetable and all resulting due dates, as additionally the tenor for such credits, were moved no matter how you look at it by a quarter of a year.

Because of this ban, people’s EMI reimbursements of credits taken were not deducted from their financial balances, giving truly necessary liquidity.

The EMI installments will restart just once the ban timespan lapses on August 31.